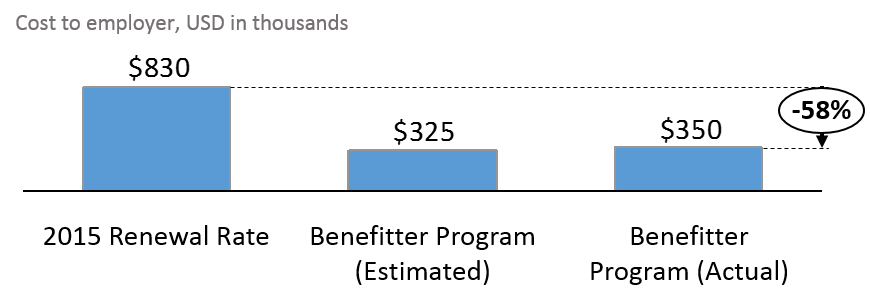

In Fall 2014, a regional broker approached Benefitter with a critical client situation. An industrial services company with operations in the Eastern US faced a major rate increase, and with narrowing margins, they were running out of options. Benefitter, with the help of our proprietary analytics platform identified over $400,000 in potential savings and developed a clear plan-of-action. In less than two months, the company successfully transitioned its workforce to the individual market using Benefitter, and reduced its health benefits expense by 58%.

Company Overview

Identifying the Opportunity

The broker who brought this case to Benefitter wanted a more effective approach to health benefits cost-savings, one without the drawbacks of typical measures such as plan reduction or increasing the employee contribution. Benefitter determined this client was an ideal candidate for the individual market, given its low participation rate (less than 63%) and high proportion of middle-income workers. These factors respectively signified an unaffordable group plan, and a workforce with broad eligibility for premium-tax credits to offset the cost of health insurance.

Compensation Adjustment

Benefitter’s opportunity estimation tool let the employer see how each worker would be impacted, based on their wage, geography, and age. Our team reviewed these estimates closely with the head of HR and the broker to develop a SmartCompensation strategy to maximize participation, and to ensure most employees would be able to replace their existing coverage at a similar cost. After considering their budget and compensation philosophy, the company decided that of the 72 employees enrolled currently under the group coverage, 51 would receive a compensation adjustment, averaging $2,200 annually per employee.

Executing the Transition

After finalizing the compensation adjustment amounts the company’s leadership team decided to green-light the transition. Benefitter immediately set in-motion a multi-pronged communication and transition project plan, including: an all-hands meeting, printed letters and mailings, an employee enrollment portal, and a dedicated team of licensed enrollment agents. Benefitter executed this transition with close support and partnership from the company’s HR team and insurance brokers.

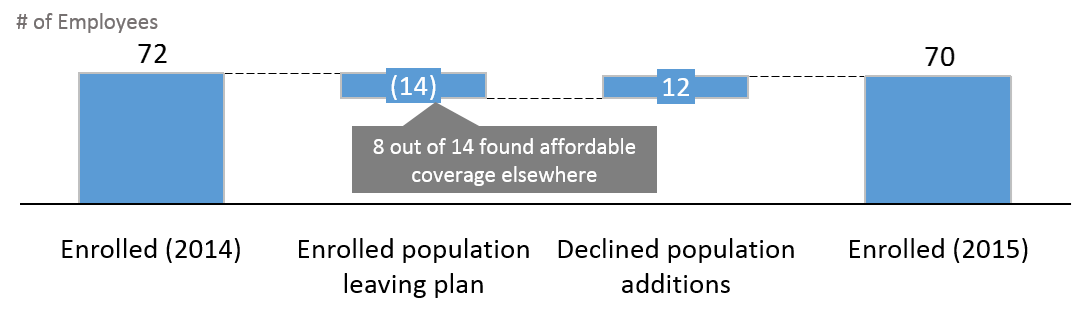

Enrollment Shifts

Of the 72 employees originally on the plan, 58 purchased individual insurance via Benefitter. The remaining 14 either sought insurance elsewhere—including spousal plans and Medicare—or chose not to participate. In addition, 12 out of the 43 or 28% of employees who had previously declined group coverage, purchased coverage through the Benefitter model, a clear indicator that the transition to the individual market increased access to coverage for employees and their dependents. Employees also selected a broad range of plan types (bronze, silver, gold, & platinum) demonstrating they could now choose the right plan for their own unique needs.

Financial Outcome and Employee Impact

The new individual market insurance saved the company over $400,000 on its annual health insurance cost, and ended the cycle of uncontrolled year-over-year rate increases. Moreover, the plans remained affordable for the vast majority of employees, with most choosing to participate in the new program, and several even finding they could afford to enroll their spouses and children for the first time. Benefitter continues to support this employer with an approach to manage and maintain the program throughout the course of the year in their continued efforts to attract and retain top talent.

[tagline_box backgroundcolor=”#d3d3d3″ shadow=”yes” shadowopacity=”0.4″ border=”0px” bordercolor=”” highlightposition=”top” content_alignment=”left” link=”http://pages.benefitter.com/demo-request.html” linktarget=”_self” modal=”” button_size=”” button_shape=”” button_type=”” buttoncolor=”” button=”Learn More” title=”Find out if Benefitter can help your organization save on health insurance costs” description=”” animation_type=”0″ animation_direction=”down” animation_speed=”0.1″ class=”” id=””][/tagline_box]