Every year, health premiums rise. That’s not news, despite recent fears around the potentially accelerating growth. Lost in the press is the fact that costs vary widely across different options. To date, few have tried to answer the question: Is health insurance on the individual exchange cheaper or more expensive than the employer-sponsored group market?

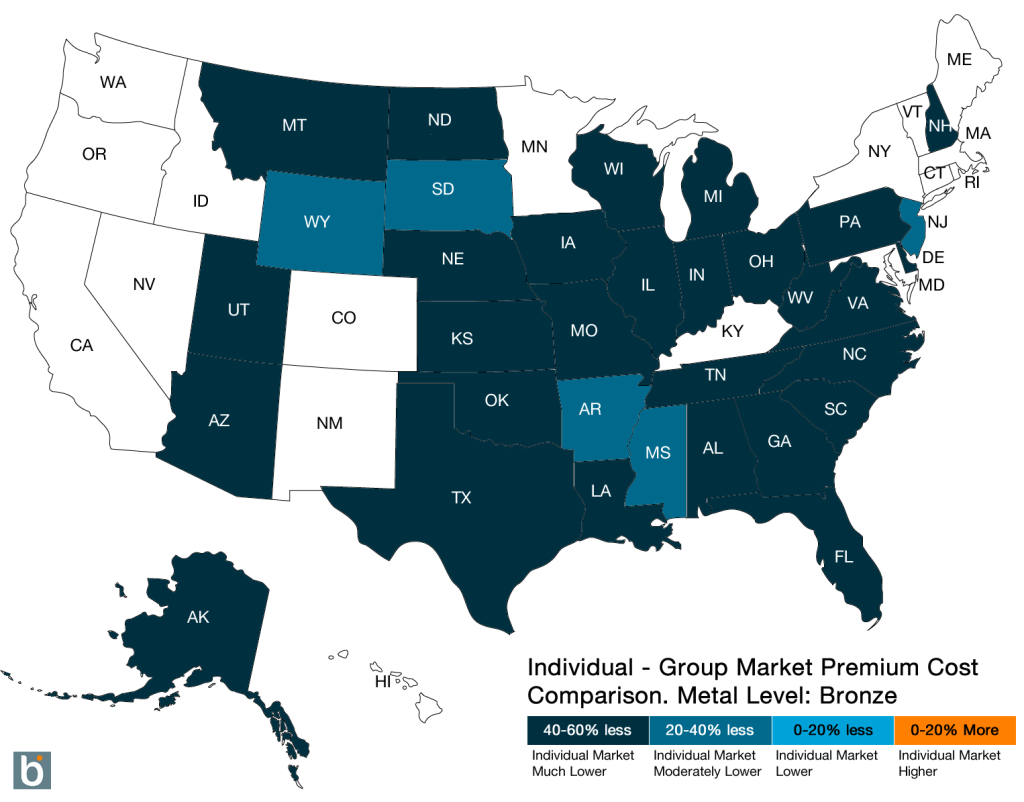

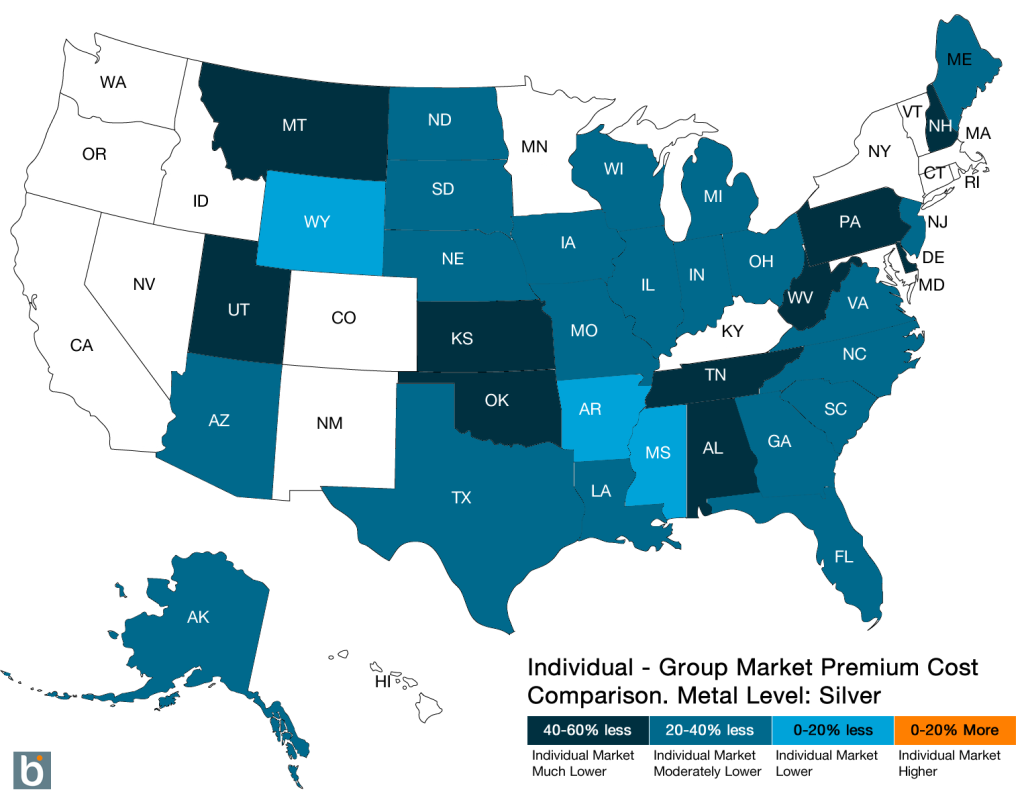

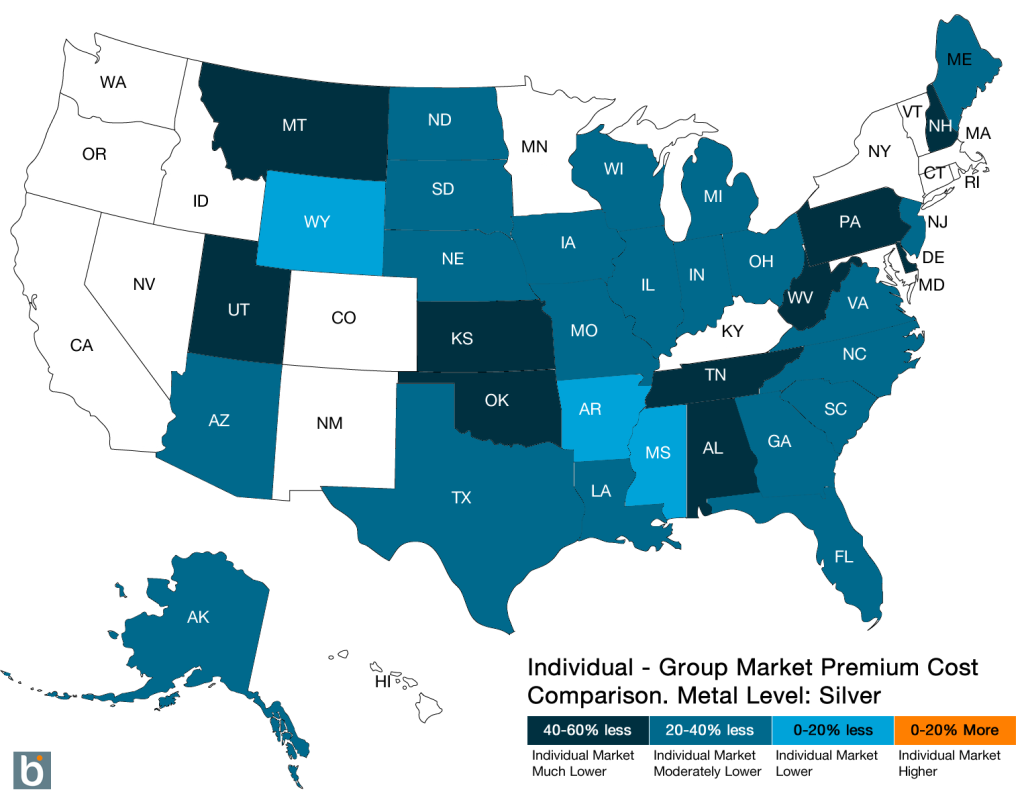

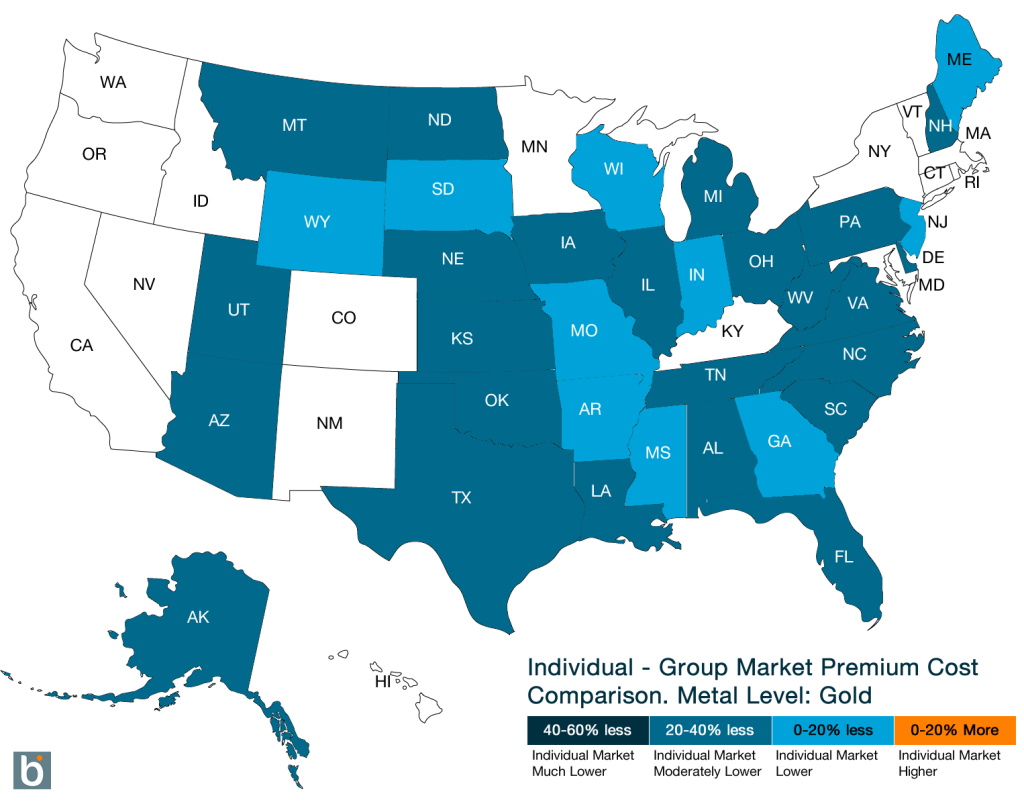

The US maps below show the state-by-state detail from our analysis of Federal Marketplace states (state-based exchanges were excluded). We found that in all states, the individual marketplace is cheaper than group insurance (aka “employer sponsored insurance” or ESI), even BEFORE you take into account government subsidies. This holds true across Bronze, Silver, and Gold plans.

Bronze plans vs group insurance premiums

Silver plans vs group insurance premiums

Gold plans vs group insurance premiums

For context, group insurance (ESI) is typically comparable to a gold plan or something less generous. According to a recent study by Health Affairs, 75% of ESI can be equated to a gold, silver, or bronze plan in terms of actuarial value (the measure of how much benefits actually cover).

Implications

With lower rates than the group market, the individual exchange now represents a viable alternative for employers seeking to cut costs while maintaining valuable health benefits.

About this analysis

We reviewed CMS data on insurance premiums on Healthcare.gov, and compared these with average employer-sponsored group rates in every state, from Kaiser Family Foundation. Specifically, we compared the median premium for a 40 year-old individual purchasing health insurance for himself, compared with the estimated 2014 ESI cost for that same individual. Darker colors correspond to states where the exchange plans are much cheaper than employer insurance, while lighter colors correspond to states where they are more similar. In no states were median exchange prices higher the group insurance. State-based exchanges (e.g. Covered CA) were not included in this analysis. Later in our series of individual vs group (US map), we will look at county-level rate info in a few select states.

Benefitter

Benefitter helps your company successfully make a transition to the individual market for health coverage and reduce your company’s health expenses by up to half, while giving your employees a comparable deal and more choices. If the individual market opportunity sounds interesting to you, check out the Benefitter story at www.benefitter.com