The Affordable Care Act has been used a bitterly partisan cudgel since the day it became law, but that doesn’t mean conservative pockets of the country aren’t eager to sign up for coverage.

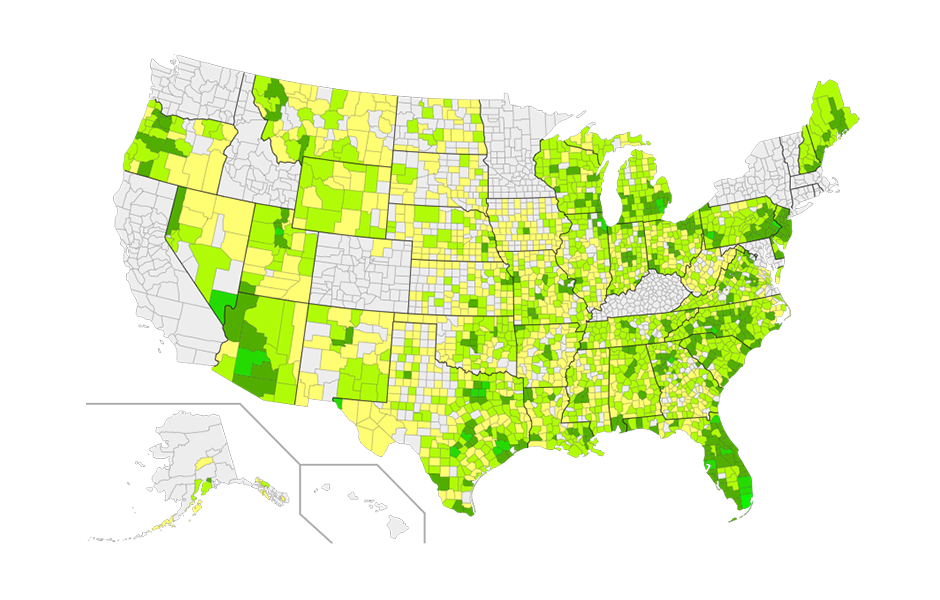

According to an analysis of recently purchased health plans by zip code from Benefitter, several deep red counties within deep red states displayed a high propensity, on a per capita basis, for signing up for Obamacare plans despite the political connotations of it and of certain regions.

Two states often associated with political leanings, Texas and Florida, show a wide and interesting range of adoption, suggesting that there’s perhaps more than politics at play, said Jonathan Pearlstein, director of marketing San Francisco-based Benifitter. In Irion County, Texas, for example, nearly 850 people out of a population of just over 1,600 signed up for individual market plans – one of the highest rates in the country.

“Some people might have assumed that people in red states or red counties would be less likely to participate in Obamacare, but if you look at the map, you don’t see that red and blue state divide,” he said. “Getting access to healthcare is not exclusively along the political spectrum.”

The data only includes states that relied the federal healthcare.gov exchange and does not include states that established their own, like California, New York or Connecticut, among others. The data does not correspond with states that accepted the Medicaid expansion, which like the federal and state exchanges largely broke down by political affiliations.

So beyond challenging political assumptions, what else do these figures tell us? For starters, it could be a great starting point for insurance carriers to target areas that did not do well and more closely examine areas that did, like South Florida, Pearlstein said

“Some of the carriers might want to look at some of the blank spots and ask why the individual market didn’t penetrate some of the areas, whether the marketing wasn’t enough or the networks weren’t robust enough,” he said.

The data also show potential for the individual market, indicating that despite the rocky roll out of healthcare.gov, it is emerging as a viable marketplace for health plans, Pearlstein said.

And that’s where Benefitter hopes to shed light: using analytics technology and research to help certain employers determine if they should continue to offer company health plans or direct employees to the individual marketplace, along with a re-tooled compensation package.

“We developed technology for small and mid-sized business that are considering dropping plans,” Pearlstein said. “For a lot of employer who have lower-income employees, they’ll actually be better off if they provide higher compensation and drop the plan.”

At one time, and likely still among certain circles, that sort of outlook would be seized upon as partisan grist, showing the uncontainable costs associated with group health plans. But the data shows that the individual marketplace is evolving into a very real and viable alternative, at least in certain regions, according to Pearlstein.

Click here for the original article.