This week Walmart announced that it will no longer offer insurance to 30,000 part-time employees. Last year major employers such as Target and Trader Joe’s did the same, but with the nation’s largest employer jumping into the mix, the political debate over the Affordable Care Act is heating up. While left-leaning outlets are using this news to show how the ACA is working, the right claims this is further evidence that Obamacare is bankrupting the country.

3 signs that group benefits are eroding

As brokers and consultants, we must stay focused on the needs of our customers and less on the politics. What Walmart’s decision signals more than anything is the continued erosion of group benefits for low-wage workers, a trend that is already well-underway. Here are 3 signs we’ve observed that show the decline of group benefits.

1) Low participation among part-time workers. An ADP research study of large employers indicated that only about 15% of part-time workers were eligible for benefits through their employers, and of those offered benefits, only about half actually took them.

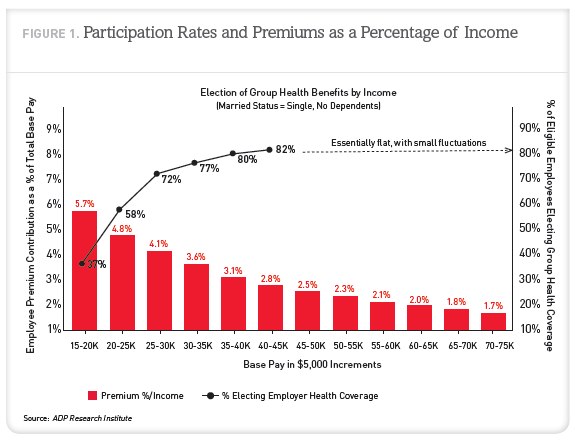

2) Low participation among low-wage workers. A separate ADP study shows that participation rates for employees making less than 40K annually start to fall dramatically and by the time you get down to 15-20K per year (the likely annual wage of part-time employees), only 37% of employees in that salary range are electing benefits.

3) Premiums are outpacing wage-growth. Because premiums grow much faster than wages, the problems stated above will only get worse. The ADP study also shows that participation starts to decline when premiums reach 3.7% of an employee’s income when making 35-40K annually, far below the 9.5% of salary that is used as the affordability benchmark under ACA.

The end-result of eroding group participation is of course adverse selection, which drives costs up for the participating employees as well as the employer. Brokers and consultants know that once the downward spiral starts it is difficult to reverse. Over time, the number of options an employer has to mitigate their ever-increasing renewals becomes more and more limited.

How to break the cycle?

The good news is the ACA is providing new alternatives and it’s up to the advisory community to bring these models to the market. Many low wage workers, including part-time employees, will find more affordable coverage through the exchanges. For some employers, the right thing to do for their business and for many employees is to no longer offer benefits, and this doesn’t only apply to part-timers.

As the role of the broker shifts further toward consulting, it’s critical to provide emerging benefit models that offer ways to break the cycle. The left and right may never agree on the impact ACA will have on our country, especially in an election year. But it is becoming clear that it can have a positive financial impact by expanding access to coverage for employees who had declined benefits that were previously unaffordable.

About Benefitter

Benefitter continues to be a leader in helping brokers and their clients evaluate, design, and implement new benefits models that aim to save money, increase access to affordable coverage, and break the cycle of unsustainable group increases. To learn more, contact us at info@benefitter.com.